The growth of neobanks across Europe has been one of the biggest disruptions to financial services over the past decade. The biggest among them have attracted tens of millions of customers with innovative digital offerings. But with so many digital banks joining the fray, there have been winners and losers.

According to Simon-Kucher & Partners, less than five per cent of neobanks globally have reached breakeven. Many in their early stages were reliant on fees from card transactions as a primary revenue stream, but now challenger banks are diversifying. UK-based Starling Bank reported its first annual profit in 2022 with the majority of its revenue coming via interest from expanded lending activities. Meanwhile, German neobank N26 increased revenues in 2021, driven by subscription income, despite making a loss of 172m euros.

Adding new services has also been a priority for Revolut, which bills itself as a “financial super app”. The company reported its first full-year profit in 2021, with more than half its revenues generated by foreign exchange and wealth services.

That is perhaps no surprise when you consider the meteoric rise of investing over the past few years, and surge in investor numbers during Covid-19 lockdowns. With neobanks continuing to capture market share, how have they responded to this demand for investment services?

We analysed 61 B2C neobanks across Europe to find out how many offer investments and what trends and opportunities exist.

Availability of investing

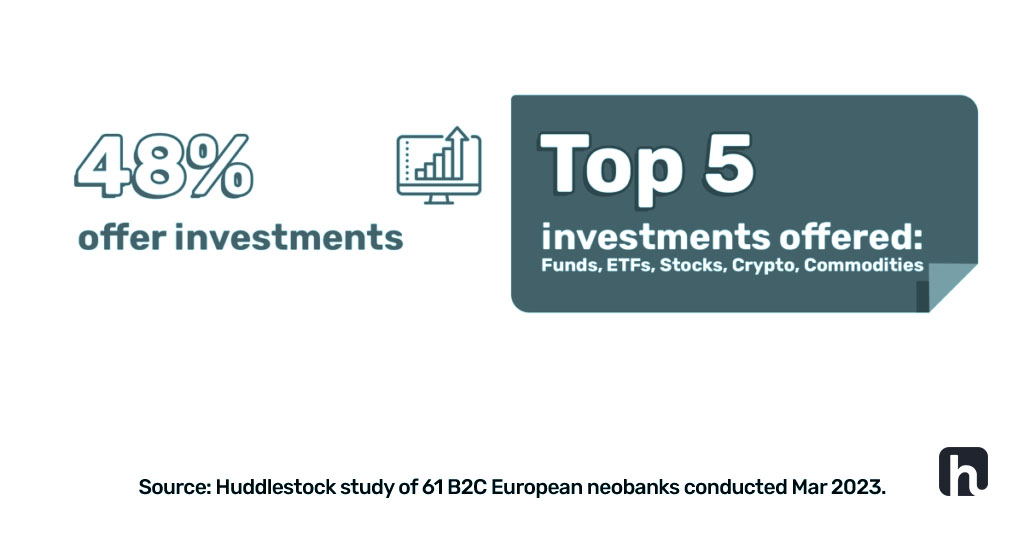

Our research shows that just under half (48%) of neobanks in Europe offer investment products. The most widely offered instruments are funds, ETFs, stocks, crypto and commodities. While 48% of digital banks offer just a single financial instrument, this is often expanded over time. Italian neobank HYPE is one example, adding stocks, ETFs and commodities to its fund and crypto investment offering in the past year.

Despite crypto providing a relatively new way to invest money, and offering more risk than traditional assets like funds, it is being introduced by a growing number of neobanks. At the beginning of 2023, N26 launched cryptocurrency trading in several countries. More digital banks are looking to get in on the act too, with Sweden’s P.F.C. and Russia’s Tinkoff indicating their intention to launch crypto investing.

Neobanks entering this space will also be aiming to boost the popularity of crypto, which varies throughout the EU. According to the World Economic Forum, which ranked nations according to the percentage of population investing in crypto, it is the wealthier and more developed EU nations like France, Germany and Italy that show the least interest. While traditional assets remain more popular for now, the gap may begin to narrow as more neobanks offer and promote services in this space.

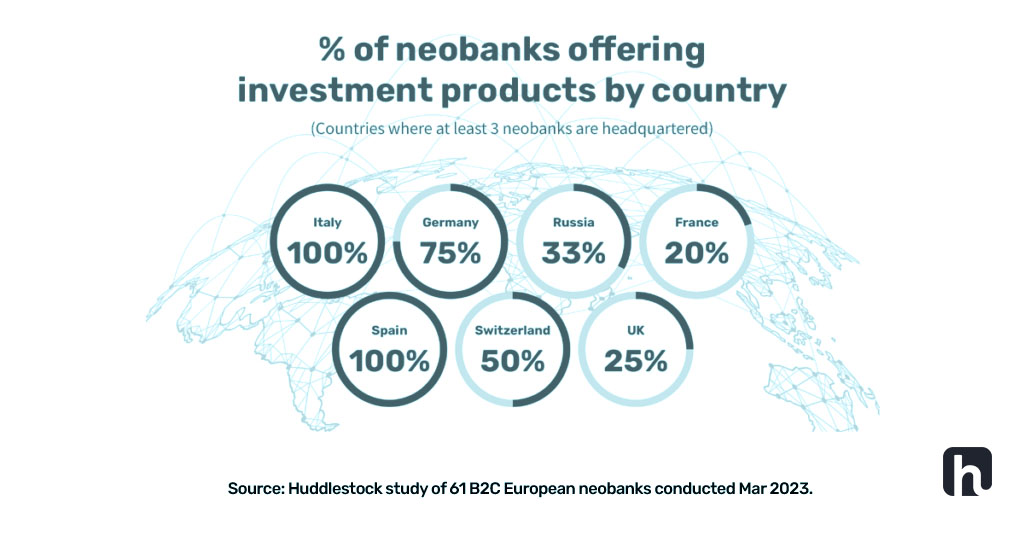

In our study, we ranked countries according to the percentage of neobanks offering investments (based on location of neobank headquarters) and found the best coverage in Italy and Spain. Notably, the UK ranked lowest of the countries with at least 3 native neobanks, with one in four offering investing.

Meeting demand for sustainable investing

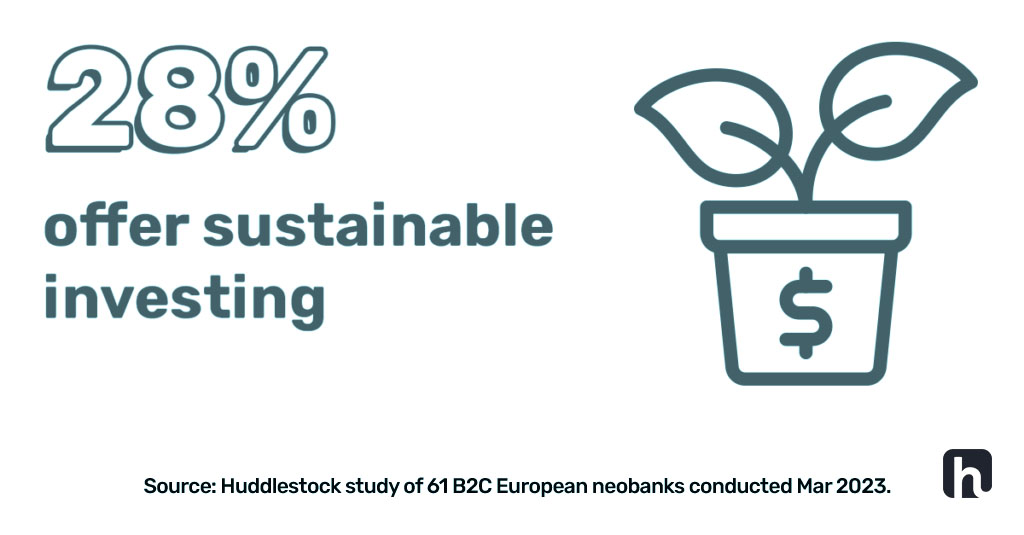

According to the European Commission’s Eurobarometer survey, 48% of Europeans said that if they know a financial product is sustainable, they are more likely to invest in it. The survey also found that around one third of respondents knew whether their investments were sustainable, and about the same number of people said they received information about the sustainability impact of financial products.

Those figures tally with our study, which indicates 28% of neobanks market a sustainable investment product. German neobank Tomorrow launched a dedicated sustainable investment offering in the last year, joining the likes of Dutch bank Bunq offering socially responsible investments.

With strong demand for these types of products, there is still a lot of white (or should we say green) space for neobanks to innovate and capture market share.

Education/learning platforms

While investing has seen a rapid rise in popularity, a lack of sufficient financial literacy in most European countries helps explain why uptake still falls short of other nations like the US, according to the EFAMA. We wrote about the role fintech has in providing investors with education in this article.

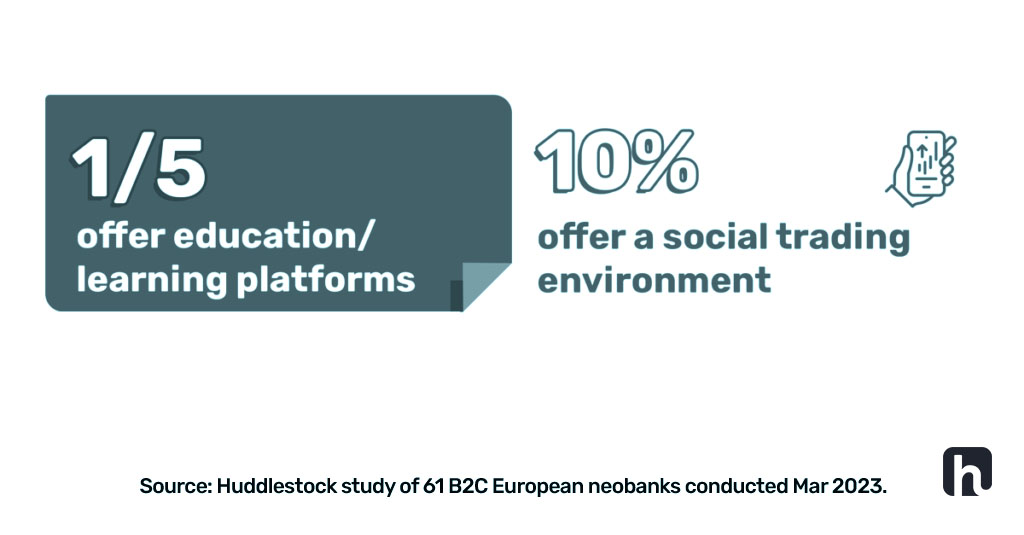

Our study showed that one in five neobanks offer dedicated education or learning platforms for investing. Neobanks have a great opportunity to align themselves with quality education and resources for their customers, where the channels, formats and delivery methods will be key in meeting customer demand.

Social investing is another way consumers can learn, share ideas and build investing strategies together. This concept is gaining more traction with investment apps like Zeed and Shares building their whole proposition around the idea. With just 10% of neobanks offering some form of social trading environment, there is still plenty of room to build in similar ideas.

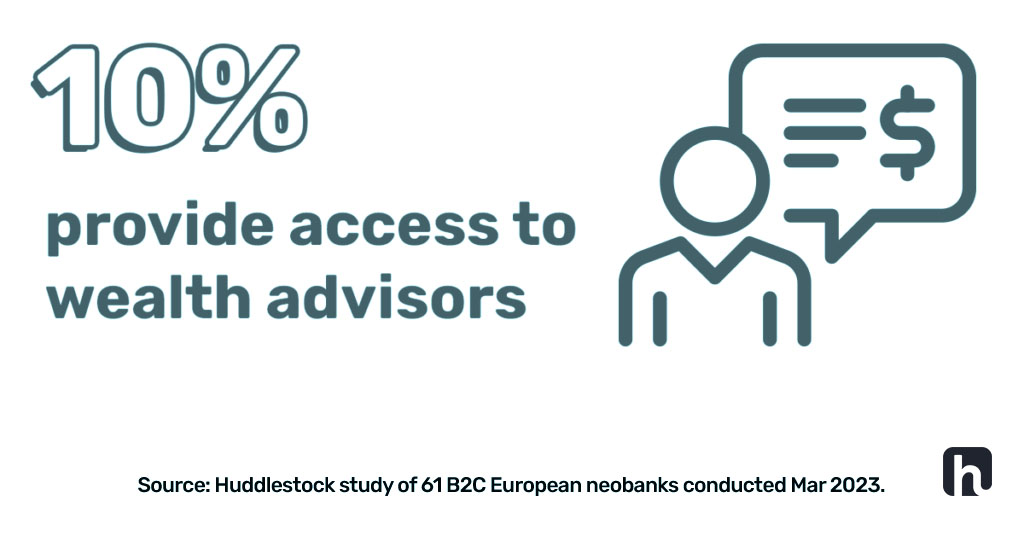

Wealth advisors

Most neobanks have chosen to launch robo-advisors – platforms that use algorithms to provide automated investment advice based on an investor’s preferences. Our study shows that just a few (10%) of neobanks offer access to wealth advisors as a premium option for wealthy customers. There are, however, signs that investment advice is starting to become more accessible through digital platforms. In the last year, Swiss neobank Alpian launched a new digital private banking platform, said to be the first of its kind in the country. The company will provide clients with an option to make in-app video calls with a wealth advisor, in addition to everyday banking services.

Elsewhere, there are further signs of democratising investment services that were once reserved for the super-wealthy. Arta Finance was launched in late 2022 and aims to replicate the family office experience for a wider audience using artificial intelligence. Target customers are those with $100,000 to several million dollars in investable assets, but that is still a stark difference to traditional family offices where clients may have hundreds of millions in assets.

What is the best route to market for neobanks?

While digital banks have made good progress opening up investment services, the majority still don’t offer any such product to customers. Half of neobanks that do offer investing, only provide access to a single financial instrument.

One of the main reasons for this is likely to do with the complexity of setting up an investment service. Neobanks building a solution face a considerable task in developing the financial infrastructure, workflows and logic necessary, in addition to securing regulatory licencing and complying with relevant legislation.

Our study shows that 59% of neobanks chose to partner up with companies offering investment-as-a-service in order to launch their offering. This method significantly reduces the time to market and eliminates cost and complexity.

To find out more about Huddlestock’s Investment-as-a-Service offering, get in touch here.